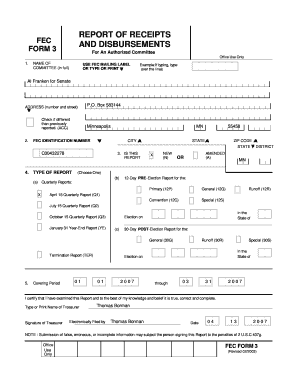

FEC Form 3 2003-2024 free printable template

Get, Create, Make and Sign

Editing 16 20 online

How to fill out 16 20 form

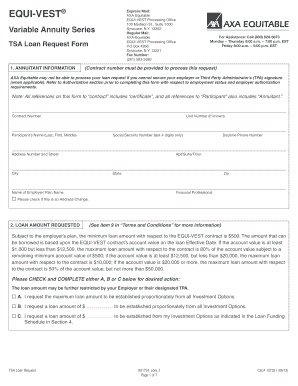

How to fill out form disbursements:

Who needs form disbursements:

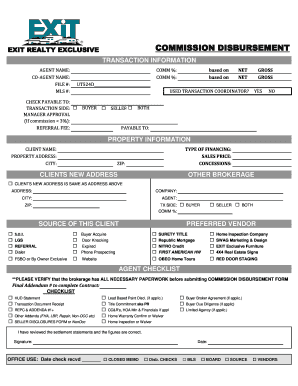

Video instructions and help with filling out and completing 16 20

Instructions and Help about form disbursements

Ok this is Mike Brennan from big brokers net we are going to learn how to do a disbursement form fill it out properly a lot of people are just putting in basic information, and we're looking for a little more than that type in WWW big brokers net / support remember it's big brokers net / support enter, and you'll see a bunch of goodies you want to scroll down to where it says disbursement form there's all alphabetized but disbursement form click on that it'll take about 10 seconds to open up depending on your speed of your internet connection, and you can save this form data on this form lots of times you will open up a PDF, and you'll type it out, and then you'll press save, and it won't work but in our case you can save the data, and it will open up here basically if you're connected to an internet you can just go to big brokerage net / support, and you'll find the discernment form or if you're just want to be smart about it just go ahead and click on file save as choose the desktop or my docs in or wherever you want to save it press save, and you'll save a blank copy on your computer so if you don't have an internet connection the blank copy would still be there by the way you should do that for all forms in the MLS so let's go ahead and show you how to fill out a form 123 maple Naperville Illinois 6056 three sellers are Joe Smith and phone number would be helpful if you have it or 2012 45 unless would be really great and buyers are in it and again phone numbers will be great and closing date is a let's see just fill it in like that the buyers address would be nice because if we have a fall through we need to know some stuff basically like that and then the city and then say so forth okay so listing office will pretend to three minutes of Naperville and the address would be nice whoops there we go boy this helps us determine which office to go to sometimes their multiple office we'll just do John Brennan as an example and 5,000 you can see that once you press this 5,000 in tab or click somewhere else it automatically that's calculated in this file let's pretend that John is also working with Jack, and he gets five thousand two, and you press tab look what happens it automatically gets to joke a lot of people have the LSP whether it be a hundred fifty-two hundred let's just pretend it's 150 a lot of people are typing in 10,000 plus 150 in pencil and then they're doing a subtotal in doing a 10,000 150 we don't care about the MLS three we really don't so if you do want to add the LSP just type it in here whoever gets it and press tab and you'll see it automatically cares about we only care about the total commission if you want to split it between two people just do it like this then tab and then it'll automatically get calculated so the selling offers let's just pretend that it's a ghoul deal without our remix enterprises office okay and we'll say and let's say Jenna gets a 4850 is that right yeah and you press tab and look at automatically...

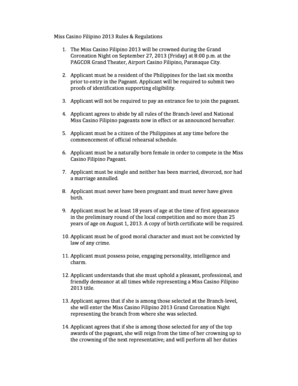

Fill 20 2017 : Try Risk Free

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your 16 20 form online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.